bear trap stock term

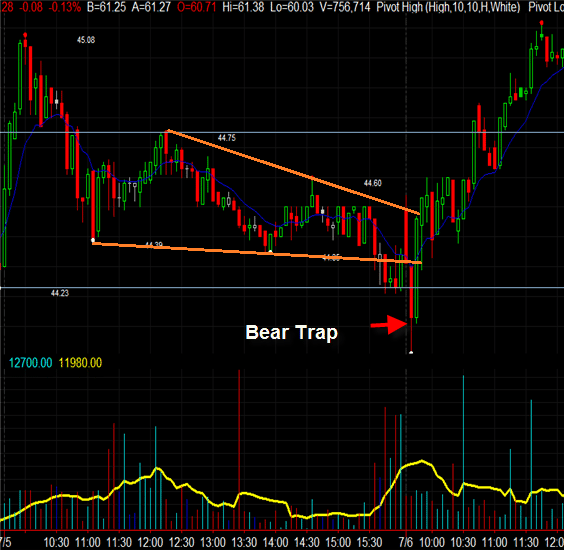

As the name itself suggests a bear trap is basically a situation when forex traders think that a support level is breaking and so as soon as price moves below the support level they start selling due to the supposed breakout. If youre thinking about short-selling or have done any research you might have heard the term bear trap This is what happens when a stock or other security stops dropping and unexpectedly begins rising.

What Is A Bear Trap Seeking Alpha

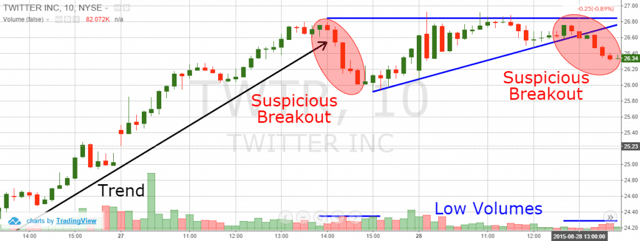

A false signal which indicates that the rising trend of a stock or index has reversed when in fact i.

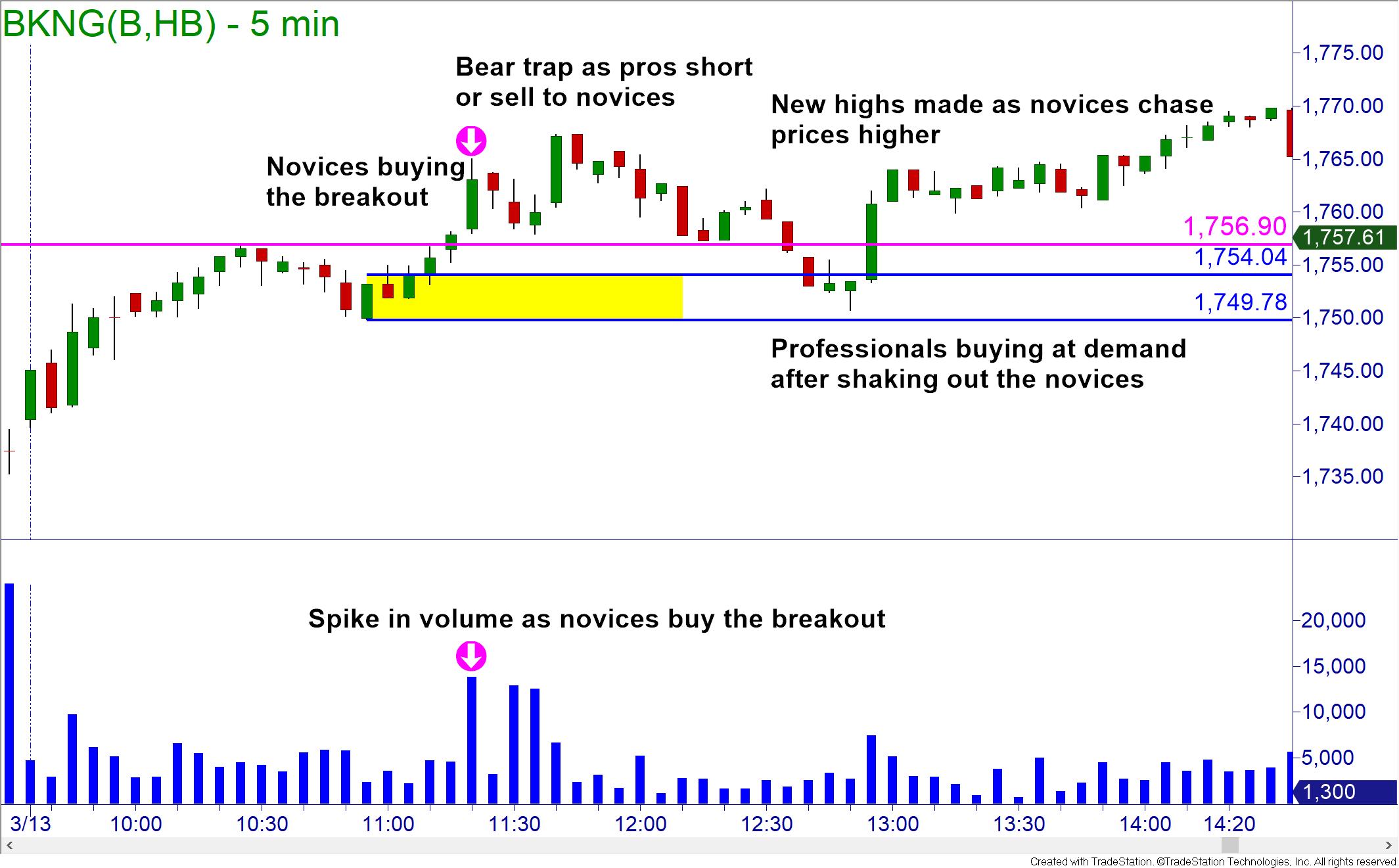

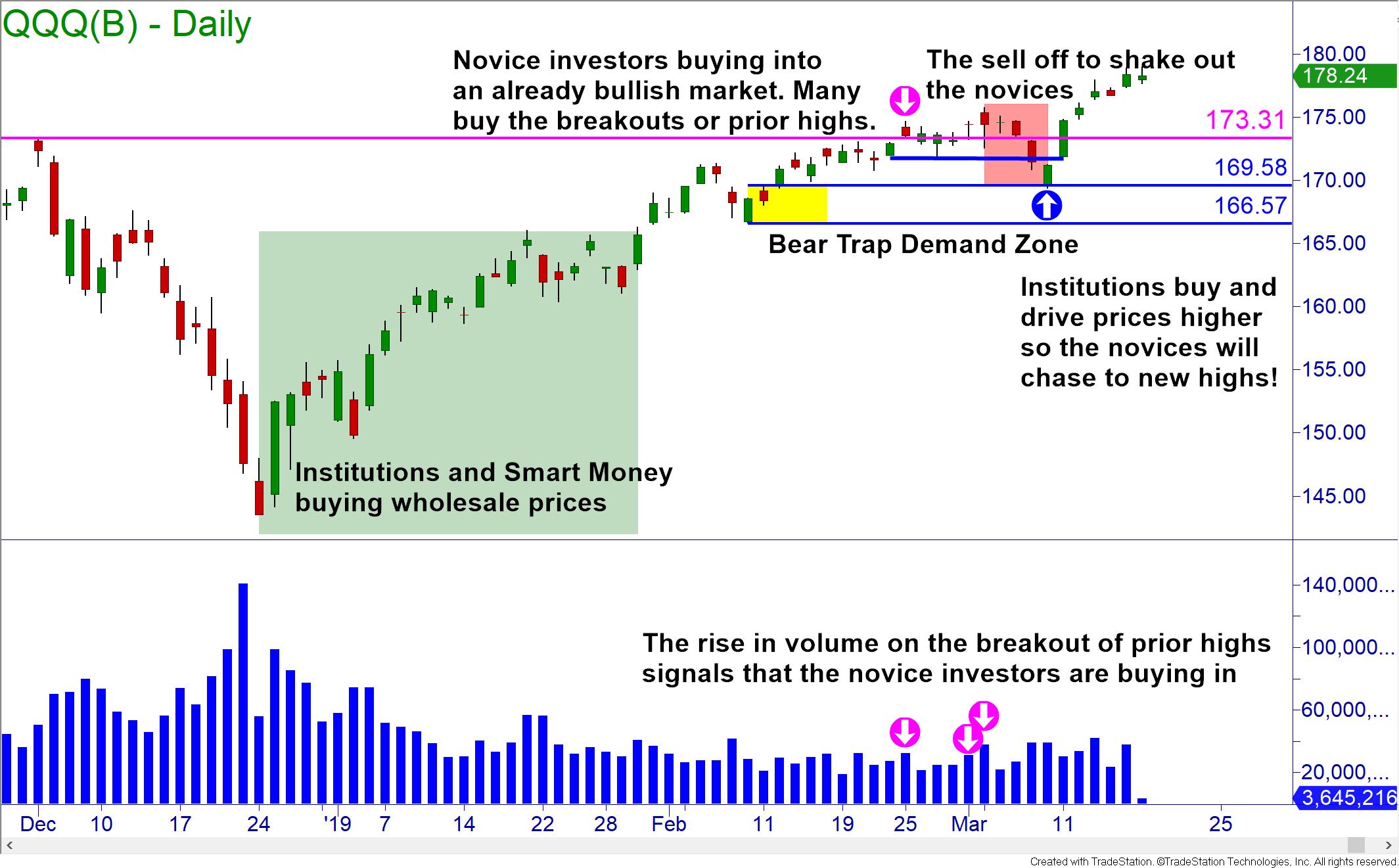

. This signals to the institutions that it may be time to. The creation of a bear trap involves the careful planning and execution of a set of circumstances in which there is sense of an impending short term fall in the price of a given security that will be followed by a long term upswing in the price. The predicament facing short sellers when a bear market reverses its trend and becomes bullish.

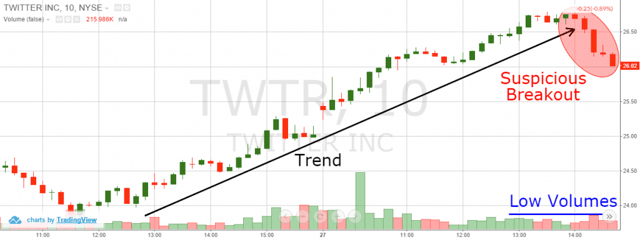

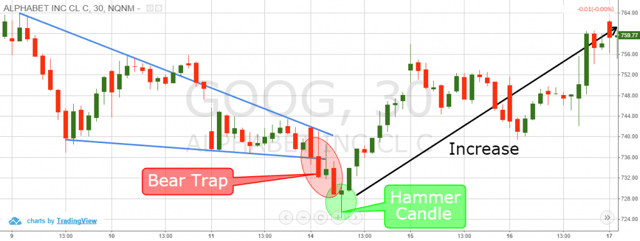

Worse yet many people are taught to buy breakouts and chase price as it moves higher. A bear trap is best-defined as a false reversal at the culmination of a pattern. A bull trap is a false signal referring to a declining trend in a stock index or other security that reverses after a convincing rally and breaks a.

Dont take a short position. Since World War II the SP 500 has experienced 17 bear markets or near bear markets according to an analysis by LPL Financials Ryan Detrick. Heres a closer look at bear trap trading.

Its an advanced trading strategy and isnt appropriate for most investors. An accumulation of shares being sold short by bears trying to drive down the price of a stock. Bear traps are similar to short squeezes but the price rallies they cause are often smaller and take longer to begin.

Bear traps occur when investors bet on a stocks price to fall but it rises instead. Selling a stock short is highly speculative and high-risk. 3 hours agoThe energy stock is one of the top 10-performing S P 500 stocks this year up more than 53.

This causes traders to open short positions with expectations of profiting from the assets price decline. What is a Bear Trap. A bear trap stock is a downward share price that lures investors to sell short but then sharply reverses with the price moving positively.

Bear traps spring as brokers initiate margin calls against investors. Oil and gas companies have seen shares climb in 2022 as the crisis in Ukraine impacts global energy. Essentially the bear trap is designed to encourage investors to buy at a higher price with the anticipation that during the.

Number 18 is all but certain to arrive soon. Whether youre a pattern trader or just have a hunch about the trajectory of a stock price its important to understand what a bear trap is as well as how to identify and avoid one. When this happens anyone who was betting on the stock to go down ends up losing money even if the stocks increase is only temporary.

If a recession does not follow the bear market stock. While not an indicator a bear trap is a technical trend or pattern that can be seen when the price movement of a stock or any financial security signals a false reversal from a downward to an upward trend. It is a false indication of a reversal from an uptrend into a downtrend.

In general a bear trap is a technical trading pattern. A Bear Trap occurs when a stock that has been declining suddenly reverses and starts to rise. A bear trap is a trading term used to describe market situations that indicate a downturn in prices but actually leads to higher prices.

The bear trap occurs when the bears find they must repurchase the shares from an individual or a group at an artificial price determined by the seller. Rising stock prices cause losses for bearish investors who are now trapped Typically betting against a stock requires short-selling margin trading or derivatives. Bear traps typically follow bullish patterns.

In the stock market traders depend on technical indicators to help them trade effectively. What is Bear Trap in the Stock Market. A bear trap in trading is a false technical pattern that can be observed when the price of an asset on the crypto or stock market incorrectly shows a reversal of an upward trend to a downward trend.

What is a Bear Trap. 1 day agoAs one would expect the short-term rebound for bear markets that are not accompanied by a recession is sharper with a median gain of 117. A bear trap is a technical pattern that occurs when the price action of a stock index or another financial instrument incorrectly signals a reversalfrom a downward trend to an upward trend.

A technical analyst might say that institutional traders try to create bear traps as a way of tempting retail investors to take long positions. What is Bear Trap. A bear trap or bear trap pattern is a sudden downward price movement luring bearish investors to sell an investment short followed by a price reversal back upward.

Bear Trap Stock is a term used in the stock market to describe a particular type of investment. It happens when the price movement of a stock index or other financial instruments wrongly suggests a trend reversal from an upward to a downward trend. Use a different trading strategy.

Many investors who have been watching the stock decline will sell it at this point because they believe that the trend has reversed and the stock will. A bear trap is the opposite of a bull trap. The simplest way to avoid getting caught in a bear trap is to avoid taking short positions altogether.

What Is A Bear Trap On The Stock Market

Bear Trap Explained For Beginners Warrior Trading

Bear Trap Explained For Beginners Warrior Trading

Bear Trap Stock Trading Definition Example How It Works

Bear Trap Best Strategies To Profit From Short Squeezes Tradingsim

Bear Trap Best Strategies To Profit From Short Squeezes Tradingsim

What Is A Bear Trap On The Stock Market

Bear Trap Best Strategies To Profit From Short Squeezes Tradingsim

What Is A Bear Trap On The Stock Market Fx Leaders

The Great Bear Trap Bull Trap Seeking Alpha

Bear Trap Explained For Beginners Warrior Trading

The Great Bear Trap Bull Trap Seeking Alpha

What Is A Bear Trap On The Stock Market Fx Leaders

What Is A Bull Trap In Trading And How To Avoid It Ig En

Bear Trap Explained For Beginners Warrior Trading

Bear Trap Best Strategies To Profit From Short Squeezes Tradingsim

Bear Trap Best Strategies To Profit From Short Squeezes Tradingsim

/Clipboard01-c2c4a2d12c05468184b82358f12a1af5.jpg)